Buying a brand-new condominium (off-plan) in Singapore is an exciting but complex process. Unlike resale homes, new launches use a progressive payment scheme, letting you pay the price in stages while the development is built. This means you can “stretch the payments over a longer time period” and take a smaller bank loan, rather than paying in full on completion.

For many experienced new launch property buyers or agents, the new launch property investment always drives up craze in news and social media. Just when you thought the property market cools down, another 90% sold for XYZ developer. Singaporeans now live in a “perfect knowledge real estate market” where plenty of real estate new launch information can be found online with detailed review.

For example: In this guide we explain each step of the new launch condo purchase process and the costs involved, so both locals and foreign buyers know what to expect.

Step-by-Step Process for Buying a New Launch Condo

Buying a new launch condo in Singapore can be both exciting and overwhelming. With demand often surging during launch phases, it’s easy to get swept up in the feeding frenzy. Developers, agents, and eager homebuyers all move quickly, and units can sell out within days.

To help you navigate this process confidently, here’s a step-by-step guide to buying a new launch condo, from initial research to collecting your keys.

No. 1: Evaluate Your Financial Standing

Buying a condo is a long-term commitment, while the proper. To avoid overstretching your budget:

- Check your Loan-to-Value (LTV) limit – Banks typically lend up to 75% of the purchase price (varies with loan tenure, age, and number of existing loans).

- Factor in Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) – ABSD applies if you already own property.

- Plan for down payment – At least 25% upfront (5% cash + 20% CPF/cash).

- Consider other costs – Legal fees, valuation fees, property tax, and maintenance.

💡 Tip: Get an In-Principle Approval (IPA) from your bank before shopping around. This ensures you know your borrowing limit.

Meet the Agent and Preview the Showflat

First, book an appointment with the developer’s appointed sales agent to view brochures and the showflat. Developers often open the showflat about two weeks before the official launch, with indicative prices.

At the showflat preview you can assess location, unit size, facilities, interior layout and developer track record before committing.

Submit LOA and Booking Fee (5%)

When you decide to reserve a unit, you submit a Letter of Authorisation (LOA) along with a blank cheque for the 5% booking deposit (to the developer’s project account). This secures your chance to ballot for a unit at launch.

The developer will then issue an Option to Purchase (OTP), confirming your 5% booking fee. (If you cancel after OTP, typically 25% of the booking fee is forfeited)

Exercise OTP and Sign S&P (Additional 15%)

Within two weeks of getting the OTP, you must engage a lawyer and sign the Sale & Purchase (S&P) Agreement. You then pay the remaining 15% of the downpayment (together with the initial 5%), for a total of 20% (in some cases 20–25%) of the purchase price at this stage. Your lawyer will lodge the signed S&P with the developer.

Don’t forget to pay the stamp duties (Buyer’s Stamp Duty and any Additional BSD) within this period.

Progressive Payments (80%)

After S&P, the remaining balance (typically 80% of the price) is paid in installments tied to construction milestones. For example, 10% on completion of foundation work, 10% on concrete framework, then smaller payments (5% each) on brick walls, ceiling/roof, fixtures, etc., and finally 25% on Temporary Occupation Permit (TOP) and 15% on Certificate of Statutory Completion.

In practice, you usually pay 10%, 10%, 5%, 5%, 5%, 5%, 25%, 15% at successive stages. (This “progressive payment scheme” means you pay by installments whenever a specified milestone is reached) These payments can be made by cash, CPF or bank loan (depending on your CPF eligibility and LTV).

Collect Keys and Defect Liability

When the condo is ready, you pay the last installments and collect the keys. There is then a 12-month Defect Liability Period during which the developer must repair any defects you report. If unit sizes end up smaller than stated in the S&P (beyond a 3% developer buffer), you can also claim a price reduction at the approved per‑square‑metre rate.

Financing & Downpayment for Your New Condo

Bank Loans: Singaporeans and PRs can obtain up to 75% Loan-to-Value (LTV) financing for their first home. (Note: if the loan tenure exceeds 30 years or goes beyond age 65, the LTV limit drops to 55%) A second home loan (with existing loans) is capped at 45% LTV, and third at 35%. Be sure to get an approval-in-principle (AIP) from a bank early on, so you know your borrowing power before booking.

All buyers must also satisfy the Total Debt Servicing Ratio (TDSR) limit of 55% (i.e. your total debt obligations cannot exceed 55% of gross income).

- Minimum Downpayment (Locals). If you are a Singapore citizen or PR buying your first property, the minimum total downpayment is 25% of the purchase price. You must pay at least 5% in cash and the remaining 20% can be paid with CPF or additional cash. For example, on a S$1 million condo, you’d need $50k in cash and $200k via CPF/cash. (If you choose a lower LTV loan, the downpayment can be higher than 25%.)

- Minimum Downpayment (Foreigners). Foreign buyers must also put down 25%, but since foreigners cannot use CPF, all 25% must be paid in cash. (Citizens/PRs may use CPF for the 20% portion; foreigners have no CPF entitlement.)

- Incremental Requirements. If you already own another property, prepare for higher downpayment and cash requirements. For a second private property, you generally need 55% downpayment (25% cash + 30% bank/CPF).

- Stamp Duties and Fees: On top of the downpayment, budget for stamp duties: BSD (Buyer’s Stamp Duty) on the purchase price (up to 4% for amounts above S$1.5m) and ABSD (Additional BSD) based on your profile. (For example, Singapore citizens pay 0% ABSD on first property, 20% on second.) See next section for details on ABSD.

- Financial Tools: Online calculators (downpayment calculators, stamp duty calculators, and progressive payment calculators) can help you estimate your cash flow. For instance, a progressive payment calculator will break down payments by stage given your price, loan and buyer type. IRAS and property portal tools can also compute your BSD/ABSD and monthly mortgage obligations, which is essential when planning your purchase.

Foreign Buyers vs. Singapore Citizen Buyers

Only private property (condominiums, executive condos, and certain strata-landed units) can be freely purchased by non-citizens. According to the Residential Property Act, a foreigner (non-Singapore Citizen or PR) can buy:

- Condominium or apartment units.

- Strata-landed houses (townhouses) within approved condominium developments.

- Leasehold interest (up to 7-year term) in a landed property.

- Landed homes on Sentosa Cove.

However, any other landed property (terrace, semi-detached, bungalow, shophouse, or strata-landed outside a private condo) requires special approval from the Singapore Land Authority (SLA). So in practice, foreigners buy condos; almost no foreign purchase of typical landed houses is allowed without an “exceptional economic contribution” case.

In addition to these restrictions, foreign buyers pay much higher stamp duties. Since 27 April 2023, foreigners pay 60% ABSD on any residential property in Singapore. By contrast, Singapore citizens pay 0% ABSD for their first home and 20% for their second.

Singapore PRs pay 5% on their first property and 30% on any additional ones. (Entities face 65% ABSD on all homes.) These rules make the upfront cash required for foreign buyers very high (see Financing & Downpayment above). Also note that only citizens/PRs may use CPF funds toward the downpayment or loan; foreigners must pay in cash.

Key Takeaways and Tools

- Plan Ahead: Before booking a unit, get a bank approval-in-principle and calculate your downpayment/cash needs (5% cash for CPF-approved financing). Remember foreigners cannot use CPF at all.

- Understand Milestones: With a new launch condo, you don’t pay 80% up front – you pay 5% (booking), then 15% more at S&P, then the rest in stages (10%, 10%, 5%, 5%, 5%, 5%, 25%, 15%). This progressive scheme spreads the financial burden over several years (use a calculator to see the breakdown).

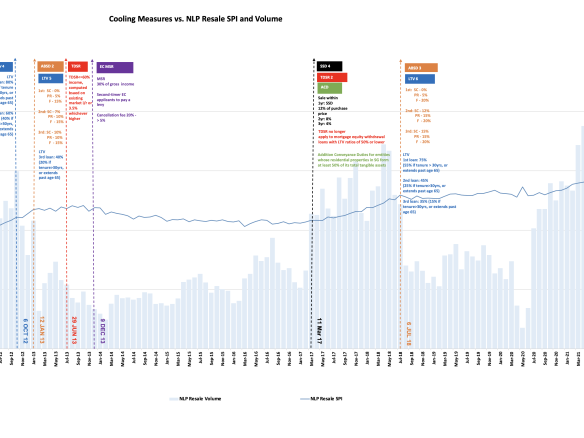

- Monitor Buying Conditions: Our new-launch property platform keeps track of the latest cooling measures and financing rules. For example, note that ABSD rates changed in 2023 (foreigners now 60%) and LTV limits were revised. Stay updated to avoid surprises.

- Consult Experts: Buying an uncompleted condo involves paperwork (LOA, OTP, S&P) and legal oversight (lawyers handling contracts). Use professional agents and solicitors who handle new launches routinely. They ensure proper documentation and advise on payment deadlines and stamp duty.

By following these steps and preparing the necessary funds, you can confidently purchase a new launch condo in Singapore. Our site is dedicated to new-launch properties and will continue to provide up-to-date guides on the buying process and regulations. Good luck with your condo purchase!

Join The Discussion