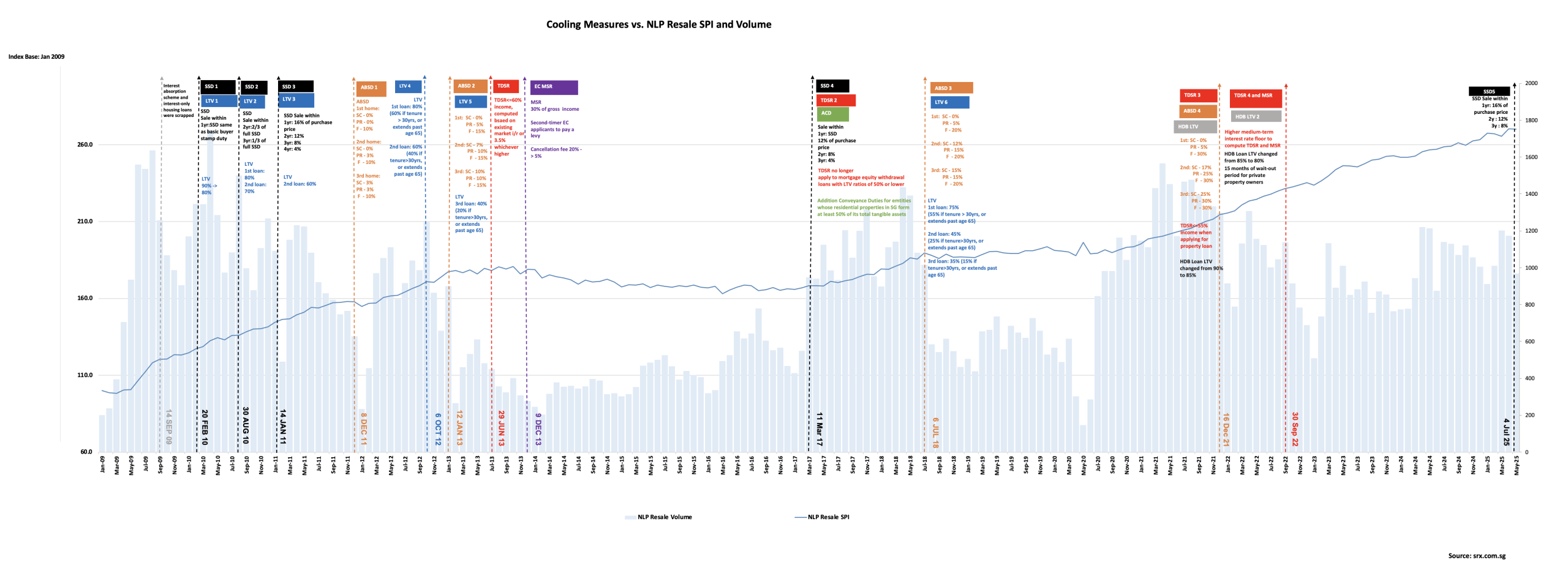

Singapore’s property market is managed for long‑term stability, affordability for owner‑occupiers, and financial prudence. Cooling measures are calibrated tools, ranging from stamp duties to borrowing caps—that dampen speculative demand, ensure sustainable household leverage, and align incentives for developers and investors. Policy dials are tightened or loosened based on data like price momentum, income growth, household debt ratios, land supply, and external conditions.

Key principle: The measures change over time. Always check dates. A measure that applied in 2021 may have been tightened (or clarified) later.

Fast Definitions

- BSD – Buyer’s Stamp Duty: Paid on all property purchases (residential & non‑residential), at marginal rates. Higher tiers apply to higher values.

- ABSD – Additional Buyer’s Stamp Duty: Extra duty on residential purchases based on buyer profile (SC/SPR/Foreigner/Entity/Trust) and property count.

- SSD – Seller’s Stamp Duty: Payable if you sell within a specified holding period (applies to residential; and to industrial property acquired on/after 12 Jan 2013). Not generally applicable to pure commercial (e.g., office/retail) disposals.

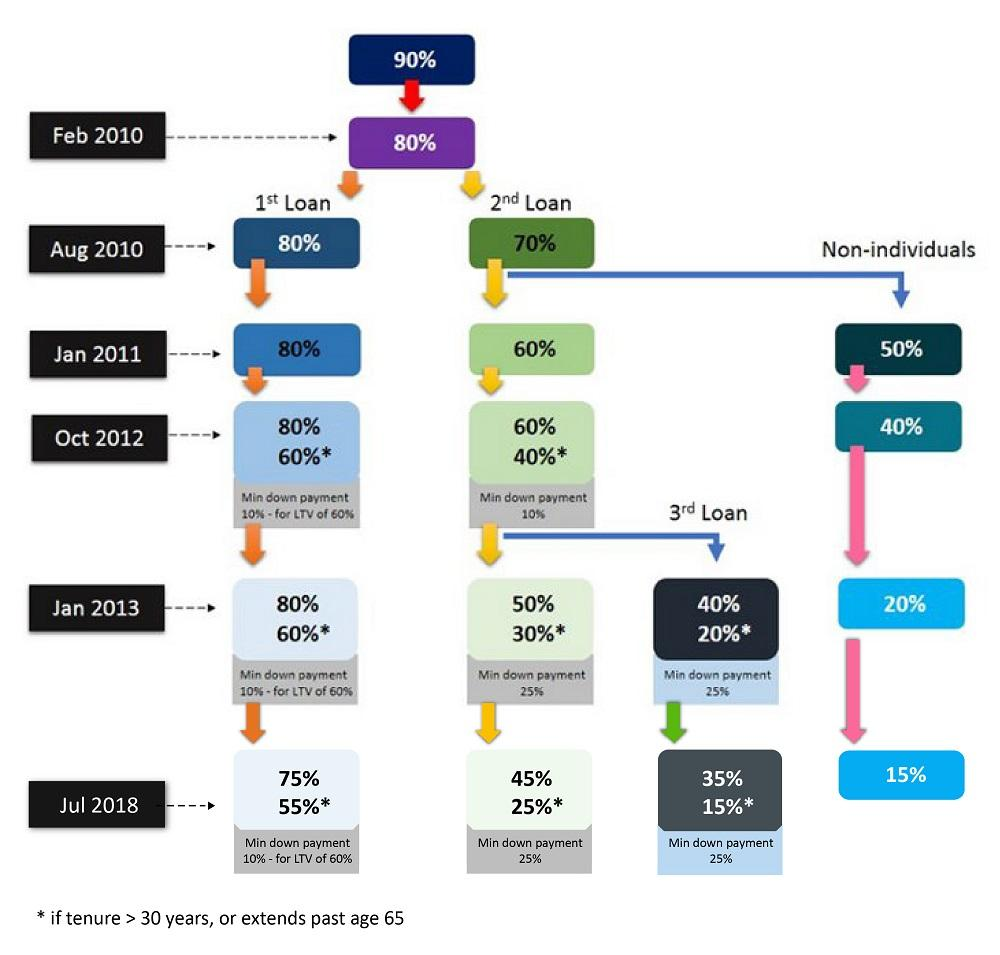

- LTV – Loan‑to‑Value limit: Max loan ratio to purchase price/valuation.

- TDSR – Total Debt Servicing Ratio: Caps total monthly debt obligations (including the new mortgage) as a share of gross monthly income.

- MSR – Mortgage Servicing Ratio: For HDB and ECs (during MOP), caps mortgage instalment as a share of gross monthly income.

Current Rules Cheat Sheet (2025)

ABSD (Residential purchases)

| Buyer Profile | 1st Property | 2nd Property | 3rd+ Property |

| SC | 0% | 20% | 30% |

| SPR | 5% | 30% | 35% |

| Foreigner | 60% (any) | — | — |

| Entity/Trust (non‑developer) | 65% (any) | — | — |

| Developer | 35% (remittable with conditions) + 5% non‑remissible | — | — |

Married‑couple ABSD remission (SC/SPR): Possible when replacing matrimonial home and meeting strict timelines/conditions (sell first home within a deadline; apply for refund within 6 months, etc.).

BSD (All purchases)

- Residential: marginal tiers up to 6% on the top value bands.

- Non‑residential (commercial/industrial): marginal tiers up to 5% on the top value bands.

SSD (Selling within holding period)

| Date of Purchase | Year 1 | Year 2 | Year 3 | Year 4 |

|---|---|---|---|---|

| Between 20 Feb 2010 and 29 Aug 2010 | Same as basic Buyer Stamp Duty | N/A | N/A | N/A |

| Between 30 Aug 2010 and 13 Jan 2011 | Same as basic Buyer Stamp Duty | 2/3 of basic Buyer Stamp Duty | 1/3 of basic Buyer Stamp Duty | N/A |

| Between 14 Jan 2011 and 10 Mar 2017 | 16% | 12% | 8% | 4% |

| On and after 11 Mar 2017 | 12% | 8% | 4% | N/A |

Borrowing Caps & Floors

- TDSR: 55% of gross monthly income (banks apply stress‑tested rate floors in assessment).

- MSR (HDB/EC): Separate cap for the mortgage portion of income.

- HDB LTV: Currently 80% (HDB loans), with HDB’s own eligibility floor used for calculation.

- Bank LTV (owner‑occupied residential): capped by MAS rules (commonly up to 75% with conditions), subject to borrower profile and outstanding loans.

Why Singaporeans, PR, & Foreigners Still Buy Singapore Property

Even with cooling measures such as ABSD, SSD, and LTV restrictions, demand for Singapore property remains strong among Singaporeans, Permanent Residents, and foreigners alike. For many locals, buying a home is more than just meeting housing needs—it is a long-term investment, a hedge against inflation, and a key way to build wealth.

Permanent Residents are equally motivated, viewing property ownership in Singapore as a way to secure their future in a country known for its stability and growth potential. Meanwhile, foreign buyers continue to see Singapore real estate as a safe haven, despite the higher ABSD rates. The nation’s limited land supply, strong rule of law, world-class infrastructure, and stable currency make it one of the most attractive property markets in Asia.

Ultimately, the fundamentals that drive Singapore’s real estate market—scarcity, stability, and steady capital appreciation—far outweigh the barriers of stamp duties and loan restrictions. This is why, regardless of nationality, buyers continue to invest in Singapore property as a reliable and resilient asset.

Timeline at a Glance (2010–2025)

2010–2013 (foundations): SSD introduced and extended; LTV tightened for multiple‑loan borrowers.

Mar 2017: Holding period for residential SSD shortened to 3 years (rates 12%/8%/4% for years 1/2/3). TDSR exemption for mortgage equity withdrawal loans (MEWL) with LTV ≤ 50%. ACD (Additional Conveyance Duty) introduced to counter “share‑deal” avoidance.

Dec 2021:

- ABSD raised for SC/SPR (2nd/3rd properties), foreigners and entities;

- TDSR tightened from 60% → 55%;

- HDB LTV cut from 90% → 85%.

Sep 2022:

- Interest‑rate floors raised for TDSR/MSR (private‑bank loans), HDB loan floor introduced;

- HDB LTV cut again 85% → 80%;

- 15‑month wait‑out for private owners buying HDB resale (with targeted exemptions).

Apr 2023:

- ABSD hiked again: Foreigners 60%; SC 2nd 20%; SC 3rd 30%; SPR 2nd 30%; SPR 3rd 35%; Entities/Trusts 65%; Developers 35% + 5% non‑remissible.

Feb 2023 (BSD): New top marginal BSD tiers: up to 6% (residential) and 5% (non‑residential) on higher value bands.

2024–2025: Ongoing clarifications (e.g., SSD rules; ABSD remission timelines for complex developer projects) and administrative refinements.

Deep Dive by Milestones

2017: Targeted Easing + Anti‑Avoidance (ACD)

What changed (effective 11 Mar 2017):

- Residential SSD holding period cut to 3 years with stepped rates 12% / 8% / 4% (Year 1 / 2 / 3).

- TDSR no longer applied to mortgage equity withdrawal loans where resulting LTV ≤ 50%.

- Additional Conveyance Duty (ACD) introduced to tax significant share transfers in property‑holding entities (PHEs), closing “share‑deal” paths that would otherwise avoid ABSD/SSD.

Why it mattered: The Government signalled willingness to fine‑tune without abandoning prudence; eased friction for longer‑term owners while clamping down on indirect share‑deal arbitrage.

[Infographic: 2017 at a Glance]

- SSD: 4 → 3 years; 12/8/4% stepdown.

- TDSR: MEWL exempt if LTV ≤ 50%.

- ACD: Share deals in residential PHEs taxed.

2021: ABSD Hike, TDSR Tightened, HDB LTV Cut

Effective 16 Dec 2021

- ABSD raised (e.g., SC 2nd 17%, SC 3rd 25%; PR 2nd 25%, PR 3rd 30%; Foreigners 30%; Entities 35%, developers 35% + 5% non‑remissible).

- TDSR tightened 60% → 55% (banks must assess borrowers against the stricter cap).

- HDB LTV tightened 90% → 85%.

Impact: Reduced leverage and higher friction for investors; first‑timers broadly shielded from ABSD but affected by HDB LTV down‑payment.

[Infographic: 2021 Rule Changes]

- ABSD matrix (Dec 2021).

- TDSR 55% cap.

- HDB LTV 85%.

2022: Interest‑Rate Floors, HDB LTV Cut Again, 15‑Month Wait‑Out

Effective 30 Sep 2022

- Interest‑rate floors used for TDSR/MSR (bank loans) raised by +0.5ppt; HDB loan floor (3.0%) introduced for eligibility calculations.

- HDB LTV further cut 85% → 80%.

- 15‑month wait‑out period for private property owners (PPOs) before buying a non‑subsidised HDB resale flat (with targeted exemptions such as seniors downgrading).

Impact: Sharper affordability guardrails amid rising global rates; tempered demand spillover from private to HDB resale segment.

[Infographic: 2022 Rule Changes]

- Rate floors (bank/HDB) visual.

- HDB LTV 80%.

- 15‑month PPO wait‑out.

2023: Big ABSD Hike (Foreigners 60%)

Effective 27 Apr 2023

- ABSD raised again for investors and non‑resident demand:

- SC 2nd: 20% (from 17%); SC 3rd+: 30% (from 25%).

- SPR 2nd: 30% (from 25%); SPR 3rd+: 35% (from 30%).

- Foreigners: 60% (from 30%).

- Entities/Trusts: 65% (from 35%;

- Developers: 35% (remittable with conditions) + 5% non‑remissible.

Why it mattered: Damped investment and foreign demand to prioritise owner‑occupation and prevent an upswing in price momentum.

[Infographic: ABSD 2023 vs 2021] Side‑by‑side matrix for quick reference.

2024–2025: Fine‑tuning & Clarifications

- BSD top tiers (from Feb 2023) remain in place: up to 6% (residential) and 5% (non‑residential) for higher value bands.

- SSD guidance updates and special‑case clarifications (e.g., matrimonial transfers, inheritance scenarios, industrial SSD holding‑period rules) published/updated.

- Developers’ ABSD timeline rules refined for complex projects (e.g., timeline extensions for certain categories from 6 Mar 2025).

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Join The Discussion