Singapore’s property market moves in cycles. Interest rates change, Government Land Sales (GLS) release fresh sites, new launches enter or exit the pipeline, and policy tweaks reshape demand. But while those macro shifts feel uncontrollable, the outcome of your sale is heavily influenced by five levers within your control:

- How you read the market and time your listing

- How you set price bands to maximise click-through

- How you prepare the home to remove buyer friction

- How you present and distribute the listing so the right buyers see it

- How you negotiate without killing momentum

Master these, and even in an uncertain environment you can Get a Better Price.

Designed by Property Launcher, this 2025 seller playbook gives Singapore HDB and private homeowners practical, no-nonsense steps supported by checklists, real examples, and incremental optimisations to help navigate new launch condo prices and achieve a stronger final outcome.

Method 1: Get a Better Price: Track GLS & Land Prices

If your planning starts after the listing goes live, you’re late. The best outcomes begin weeks earlier with a calm, data-first scan of your micro-market.

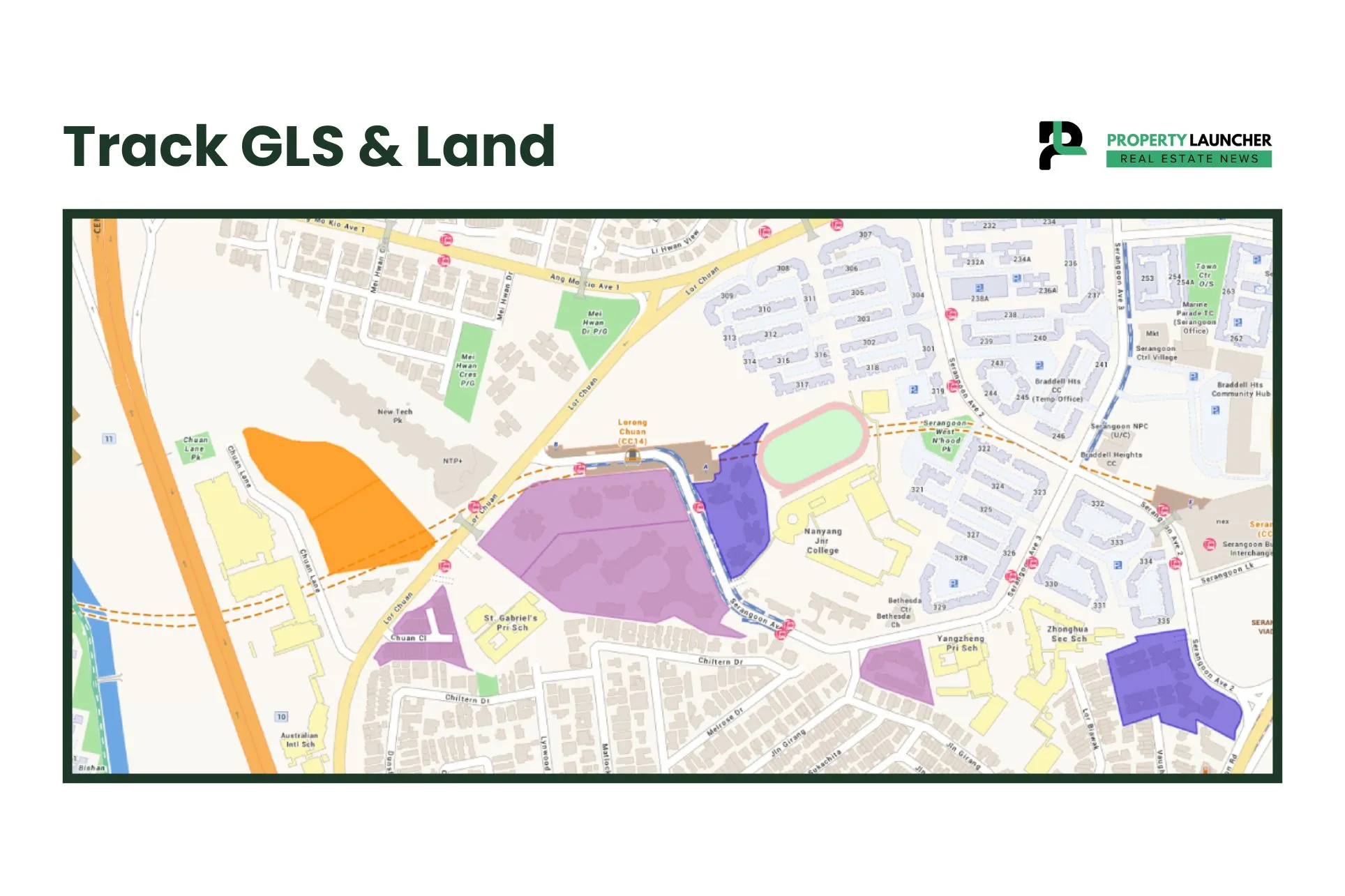

Track GLS and New-Launch Signals Around You

GLS results today are tomorrow’s launch prices. A strong tender price (psf ppr) usually implies a higher developer breakeven and, later, a higher launch PSF in that micro-location. If a nearby site has been awarded especially to a premium developer expect the new launch to anchor buyer expectations.

How this helps you Get a Better Price

- High-PSF launch within 1–2 MRT stops:

Position your unit as the value alternative—ready move-in, lower quantum, often larger liveable space for the same budget. - No nearby launch:

Benchmark against the best recent comparables and craft a “clear first choice” narrative (condition, layout, privacy, orientation).

Practical actions

| Action | What to Watch | Timing Tip |

|---|---|---|

| Track GLS & previews | Announced GLS sites, estimated preview windows | Align your listing window to upcoming interest |

| Monitor pre-launch buzz | Hoardings up, agent chatter, early marketing claims | Use early signals to shape pricing & positioning |

| Choose list timing | Before preview (catch comparisons) or shortly after launch (buyers seek value) | Pick the slot that best positions you against launch momentum |

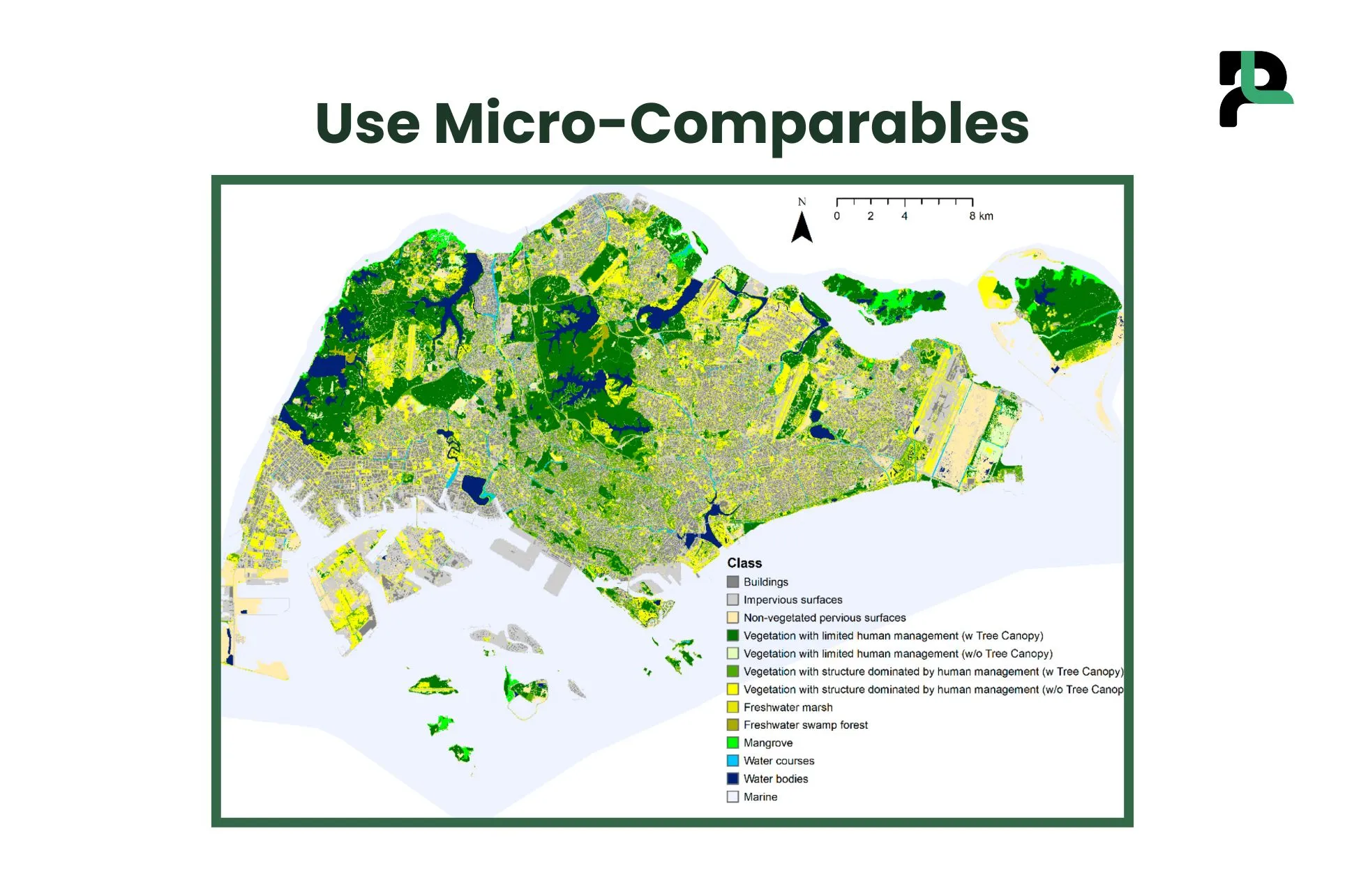

Use Micro-Comparables, Not Just District Averages

District averages blur what buyers actually experience. A quiet, high-floor inner stack with greenery does not compete the same as a road-facing stack at the same PSF. Buyers compare like-with-like: stack, facing, height, sun path, noise, renovation state, and MCST quality.

Checklist for micro-comps

| Criteria | Match / Example |

|---|---|

| Same project or close peer | Comparable estates with similar facilities & upkeep |

| Same stack direction & floor band | e.g., NE/E vs W-facing; similar height range |

| Similar renovation age & scope | Kitchens/bathrooms of comparable age & spec |

| Similar view & privacy | Unblocked greenery vs inward over plant/equipment |

| Recency | Closed in last 3–6 months to reflect sentiment |

Choose Your Sell Window (Not Just Your Price)

Timing changes outcomes. Listing into a crowded window (multiple TOPs, major showflat opening, long holidays) can mute exposure. Avoid launching the same week competing estates hold mass viewings—unless you’re piggybacking with a sharp value story.

Timing tips

- If several projects in your node hit TOP next quarter, list earlier so you’re the “available now” option.

- For family-sized homes, note school calendars; some buyers plan by terms.

- Weekday evenings often attract serious, time-pressed buyers—don’t default to weekends only.

Positioning quick-reference

| Scenario | Likely Launch PSF (illustrative) | Your PSF/Quantum Stance | One-Line Message |

|---|---|---|---|

| Launch 500–800m away, premium branding | $2,600–$2,900 | $2,2xx–$2,4xx | “Same node, lower quantum, ready now.” |

| No launch within 1–2 MRT stops | — | Match best recent comps | “Best value in estate; renovated & efficient layout.” |

| Multiple launches in pipeline | Higher variance | Conservative ask; flexible terms | “Certainty today vs wait-and-see.” |

Method 2: Use the new-launch lifecycle to your advantage

Not every launch is a weekend sell-out. Across many projects, the pattern is familiar: stronger pace in the early months, then price creep or higher-quantum leftovers as the project approaches TOP. That lifecycle creates pockets of opportunity for resale sellers.

Year-1 price creep & TOP tail

Developers often adjust prices after the first 12 months. Even without price hikes, the unsold mix tends to skew toward larger, higher-quantum units. When budgets cap out, buyers who still want the location broaden their search to nearby resale options.

Seller move: If the competing launch is well into its cycle and marketing at its firmest prices, test a slightly firmer ask for two weeks while enquiry velocity is high. Your advantage is quantum, readiness (no construction wait), and mature estate livability.

Watchpoints to adjust fast

- Sudden discounts or star stack releases: Recalibrate promptly; don’t cling to an ask that’s just become uncompetitive.

- Micro-supply shocks (TOP clusters): If multiple estates TOP together, listing just before the crowd can protect your exposure.

- Hype vs reality: Fact-check claims against actual transacted PSF and the unit mix still available.

The goal is not to copy the launch; it’s to place your home as the rational, attractive alternative during each phase of that launch’s journey.

Method 3: ECs nearby? Don’t auto-discount—price to lived value

When a neighbouring Executive Condominium (EC) hits MOP, many private sellers assume they must price below it. Not true. ECs sometimes win on PSF due to freshness and planning; older private condos can still win on quantum for lived value (address, privacy, tenure, micro-location). The fix isn’t panic—it’s precision.

What Buyers Actually trade off (quick matrix)

| Dimension | Typical Private-Condo Edge | Typical EC Edge | Notes for Pricing |

|---|---|---|---|

| Tenure / Status | Freehold/999 in some areas; fully private prestige | Usually 99-year; “EC” label still lingers until year 10 | Private can justify a premium for tenure/status in CCR/RCR pockets |

| Planning & Specs | Mature estates may have larger rooms, better landscaping | Newer fittings, efficient layouts, more power points/storage | ECs feel “move-in ready”; stage to neutralize if you’re private |

| Micro-location | Closer to mature nodes, MRT interchange, F&B clusters | Often slightly fringe to capture land value | A 5–10 min location advantage is felt in daily life—price it in |

| Privacy & Orientation | Quieter inner stacks, greener outlooks in some older projects | Newer but sometimes denser; watch facing/pool equipment | Lived privacy beats brand-new if buyer’s daily use is better |

| Near-term capex | Some lift/ façade/ pool M&E refresh risk | Low near-term capex right after MOP | Transparent MCST docs help private justify price vs “unknowns” |

| Buyer pool rules | Fully open market | Years 5–10: sellable to SCs/PRs; Year 10+: fully privatized | EC pool broadens at year 10—affects long-run story, not today |

EC rules in brief: after 5-year MOP, ECs can be resold to Singapore Citizens and PRs; after 10 years, they’re “privatized” and can be sold to foreigners.

If you’re a private-condo seller, do not reflexively undercut a nearby MOP EC. Anchor your narrative to what private buyers care about: address quality, tenure, micro-location advantages, privacy and orientation (quiet inner stacks, greenery outlook, no afternoon sun).

Many buyers will pay similar quantum for those lived-value benefits.

If you’re the EC seller (at/after MOP), you don’t need to chase private neighbours down the ladder. Lead with freshness (renovations and fittings still modern), functional planning (efficient layouts), and lower near-term capex (newer estate). Price where your buyer profile sees value: families upgrading from HDB, location-loyal buyers who prefer ready-to-move units, tenants who value modern conveniences.

Price to the buyer’s lived value, not a knee-jerk EC < private rule. That is how you Get a Better Price in mixed market conditions.

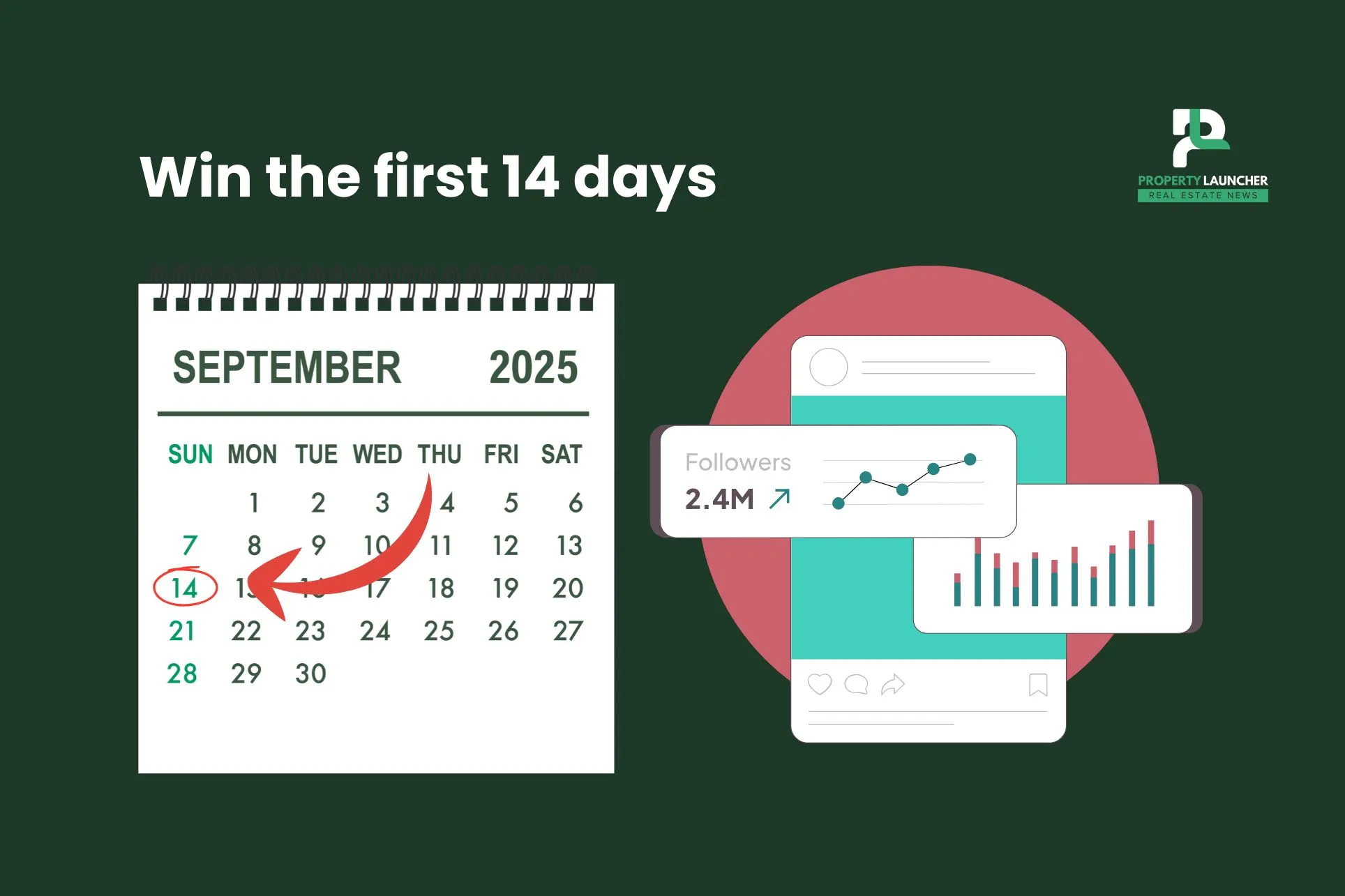

Method 4: Win the first 14 days—price for click-through, then protect momentum

On most portals and social feeds, attention clusters early. The first 14 days often generate the most views, enquiries, and your best offers. Treat that window as a controlled experiment: win clicks, convert to viewings, and create the conditions for multiple offers.

Quantum bands that unlock traffic

Buyers filter by round-number brackets: sub-$1.5M, sub-$2M, sub-$2.5M, etc. If your intended price sits just above a band (e.g., $2.02M), testing $1.98M can materially expand your audience. The small headline move pays off in impressions → CTR → enquiries—and competition is what pushes final price, not a static ask.

PSF-gap narrative vs the launch/best comp

If a nearby launch markets at $2,600–$2,900 psf and your estate trades at $2,2xx–$2,4xx psf, say that. Give buyers a clear apples-to-apples frame: “Lower PSF and quantum here, ready now, larger usable space, quiet inner stack.”

Use that narrative in the listing copy and—more importantly—during viewings. Buyers don’t just scan numbers; they remember frames.

Your 14-day cadence

| Window | Focus | Do | Evaluate / Notes |

|---|---|---|---|

| Days 1–3 | Baseline | Publish with the strongest hero image and a clear headline (project + unit type + best two benefits). | Track impressions, CTR, and enquiry quality. |

| Days 4–6 | One change | If CTR is low vs impressions, adjust one variable only: headline or hero image or price band. | Re-assess CTR & enquiry mix after 48–72 hours before changing anything else. |

| Days 7–10 | Presentation pass | If viewings are healthy but offers are weak: fix visible defects, improve staging, add daylight photos, and state orientation/privacy clearly in the first paragraph. | Prioritise presentation over discounting; watch offer quality and viewing feedback. |

| Days 11–14 | Decide | If multiple serious offers: run a documented, time-boxed best-and-final. If one clean offer near target: weigh certainty of close vs waiting. If funnel slows: make a minor price tune or start a pause-and-improve cycle (fresh hero, new angles). | Choose the path that maximises momentum and protects outcome. |

Why early acceptance can be smart: In turning markets, the first good price is often the best price you’ll see—because novelty decays and buyer confidence swings with headlines.

Method 5: Don’t open with a record-breaking ask—create competition first

When headlines are upbeat, it’s tempting to peg your ask at (or above) the highest recent sale. That can backfire. Many buyers don’t “negotiate down” from an unbelievable number—they skip the listing, and you lose the chance to create price tension.

Anchoring psychology (and how to use it)

A believable ask inside a popular quantum band earns you clicks and viewings. Viewings create the conditions for multiple offers, and multiple offers are how you ultimately Get a Better Price than a lonely record-chasing sticker would have delivered. Momentum—not optimism—sets pricing power.

Trade terms before quantum: the concession tree

Go into negotiations with a written concession tree, so you don’t throw away price too early:

- Inclusions first (white goods, selected furniture, curtains/blinds)

- Completion timeline flexibility (minor date shifts)

- Quantum movement (only after 1–2 are deployed)

By trading convenience and certainty first, you protect your headline outcome and keep negotiations collaborative, not adversarial.

Best-and-final etiquette

If multiple offers surface, use a clear reply-by deadline, acknowledge competing interest without disclosing specifics, and request proof of funds/approval-in-principle as relevant. A clean, professional process sustains momentum and reduces fall-through risk—two ingredients that underpin strong final prices.

FAQs (quick, scannable)

1) Is now a good time to sell in Singapore?

It depends on your micro-market. If a high-PSF launch is coming near you, consider listing earlier and framing your home as the ready-now, lower-quantum alternative. If nearby supply is thin and enquiry steady, you can afford a firmer stance.

2) Do I need to price below valuation to Get a Better Price?

Not necessarily. Price inside a popular quantum band to widen your audience. Then use a clear PSF-gap narrative (vs the launch or best comp) and strong presentation to support your number during viewings.

3) Do nearby launches help or hurt resale prices?

Both effects show up. Launches anchor expectations higher, but they also make your larger liveable space at a lower quantum look attractive. Your job is to spell out the trade-off in concrete terms.

4) How close to MRT matters most for resale?

Within ~500–800m generally boosts liquidity. If you’re further, emphasise other strengths: quiet stack, greenery or view, layout efficiency, renovation quality, or proximity to specific schools/amenities.

5) Exclusive agent or open listing?

One accountable professional, executing a unified launch (media, pricing cadence, reply scripts), often outperforms fragmented efforts. Consistency, speed, and negotiation discipline are what create momentum.

Control the controllables and let momentum lift your price

You can’t set interest rates or policy. You can decide to read GLS and launch signals early, time your listing around the lifecycle of nearby projects, price where buyers actually click, protect the first 14 days with disciplined experimentation, and negotiate via a concession tree that trades terms before quantum.

Do these five things right, and you significantly improve your odds of identifying affordable new launch condos in 2025’s evolving market, no matter what the headlines say.

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Join The Discussion