Accurately comparing condo prices is one of the most important and misunderstood steps in the buying process. Many Singapore buyers rely on surface-level PSF data or outdated transaction records, without recognising how factors like launch type, project age, and market timing can dramatically distort true value.

At PropertyLauncher, our team analyses hundreds of developments across every district to help buyers make data-driven decisions. Drawing on real transaction insights and URA-verified data, this guide highlights five critical mistakes property seekers often make when comparing condo prices and how to apply the right evaluation framework before making your next purchase.

New Launch vs. Subsale vs. Resale: How Transaction Type Impacts Condo Prices

When you purchase directly from a developer, early entry often leads to stronger capital gains but timing is everything. Developers typically adjust prices upwards as sales progress, so buyers who enter later phases usually face higher entry costs and lower overall returns.

Our analysis of more than 20,000 new-launch transactions since 2011 found that the first 30 % of buyers at a launch achieved average returns of around 29 – 31 %, while those who bought near the end averaged closer to 26 – 27 %. This shows how early positioning can make a measurable difference in performance.

Subsequent buyers in the subsale or resale stages see different results again, as pricing dynamics shift once construction progresses and ownership changes hands.

For investors, the key takeaway is comparison fairness. Sellers sometimes highlight new-launch performance and contrast it with resale projects to make returns look stronger than they are. To get a true picture, always compare like-for-like new with new, subsale with subsale, resale with resale instead of relying on simplified average returns.

Forgetting to Check When Each Condo Was Bought and Sold

Market timing is one of the most overlooked factors when evaluating condo prices performance. Each property cycle carries different external conditions — from government policies to macroeconomic shifts that can significantly affect transaction outcomes.

For example, units sold near the 2013 peak often delivered modest gains, not due to poor asset selection but because sellers exited just before a period of intensified cooling measures and slower market activity. In contrast, buyers who entered the market between 2016 and 2017 benefited from lower entry prices during a downturn and generally achieved stronger appreciation as the recovery took hold in subsequent years.

These cases illustrate that apparent differences in returns are often the result of timing, rather than project fundamentals. A condo purchased at the top of the cycle will naturally show weaker percentage gains than one acquired at the bottom, even if both are quality developments.

When comparing performance across projects or districts, it is therefore essential to align entry and exit years to ensure a true like-for-like comparison. Ignoring this context can lead to distorted conclusions about which condos genuinely outperform the market.

Average Condo Prices Don’t Tell the Full Story

It’s tempting to rely on the project’s average ROI or PSF to judge performance — after all, it’s the easiest number to find. But averages often hide what’s really happening within a development.

A condo isn’t one uniform asset. Each unit type whether it’s a compact one-bedder or a spacious four-bedroom layout behaves differently in the market. Smaller units often attract investors and tenants, while larger ones depend more on genuine home buyers. Because of that, price movement can vary widely even within the same project.

Take a closer look at market data and a clear pattern emerges: certain unit types hold value better than others. In some high-end developments, two-bedroom units continue to sell steadily, while oversized family layouts stagnate because of their higher overall price tag. On paper, the PSF might look attractive but buyers hesitate once the total quantum crosses a certain threshold.

So when comparing condo price performance, don’t stop at the headline number. Focus on the specific unit size and layout that fits your budget or investment goal. That’s where the real story and the real opportunity lies.

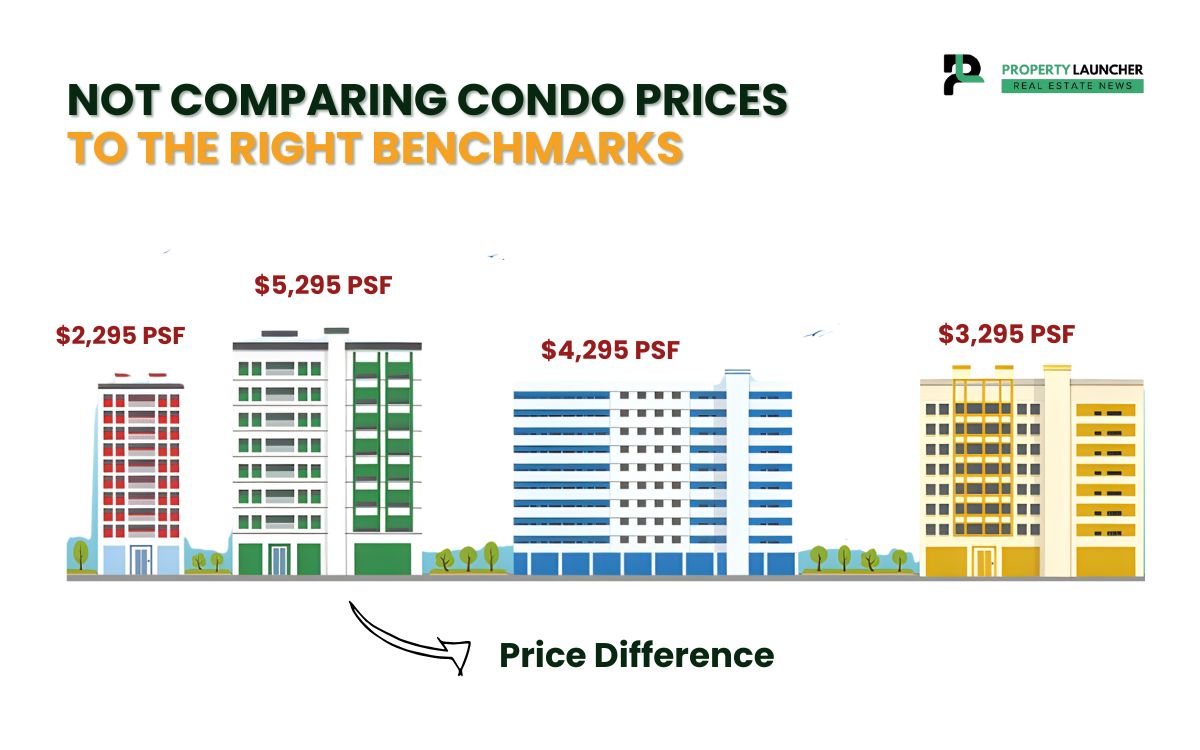

Not Comparing Condo Prices to the Right Benchmarks

A condo’s performance can seem impressive at first glance, a 25% increase over ten years looks strong on paper. But that number alone doesn’t tell the full story. Without proper benchmarking, even an average result can appear outstanding.

Take The Interlace for example. Between 2009 and 2024, it achieved an annualised return of about 3.05%. That might sound decent until you compare it to the islandwide average of roughly 5.9% for similar 99-year leasehold condos. In that context, its growth lags behind both the market and peers launched in the same period.

The same pattern shows up with Forest Woods in District 19. From 2016 to 2024, it recorded an annualised gain of around 4.4% and no loss-making resale transactions, a seemingly healthy outcome. Yet, when measured against its district and islandwide averages of about 7.8%, the performance looks less impressive. It’s not underperforming; it’s just keeping pace with its pricing tier rather than leading it.

That’s why benchmarking matters. Condo prices appreciation only has meaning when viewed alongside comparable projects those with similar tenure, age, and market cycle. Looking at a single ROI figure in isolation is like judging a marathon by one checkpoint you’re missing the rest of the race.

Forgetting That Every Condo Starts at a Different Price Point

Comparing condo performance can be tricky because not all projects start from the same point. A property’s appreciation rate doesn’t always tell the full story, especially when one condo launched at a much higher baseline due to its location, design, or developer branding.

Take Reflections at Keppel Bay as an example. It’s often labelled as an “underperformer,” yet that misses the context. When launched, Reflections carried a premium — its waterfront views, bold architecture, and larger unit layouts placed it in a different class altogether. Comparing its growth rate to nearby, mass-market condos is unfair. Buyers of Reflections weren’t just paying for square footage. They were buying exclusivity, design, and prestige.

This same dynamic applies to new launches versus resales. A brand-new development will almost always be priced higher than its surrounding resale neighbours, simply because it’s new. Over short windows say, within five years that premium can make appreciation appear slower, even though long-term value and desirability often remain strong.

Comparing projects without accounting for their starting positions is like comparing a luxury sports car to a five-year-old sedan both get you from A to B, but one was built for a completely different experience.

Seeing the Bigger Picture: What Smart Buyers Understand

Ultimately, every condo’s price story is shaped by its starting point, its audience, and its purpose. Some developments are designed for steady, mid-market appreciation, while others are built as prestige statements with a premium baked in from day one. Neither is “better”, they simply serve different goals.

The key is context. Before judging performance, align your comparisons with similar condo tiers, locations, and target buyers. That’s how informed investors and home seekers make sense of Singapore’s property market not by chasing the highest percentage gains, but by recognising true, sustainable value.

We analyse every project, from luxury launches to suburban family condos, helping buyers assess new launch condo prices objectively and make informed decisions.

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Discover Singapore’s latest launches in CCR, RCR, OCR and EC—complete with live price lists, PSF ranges, floor plans and daily refreshes.

Join The Discussion